south dakota excise tax license

Veterans as defined in section 7 of chapter 4 of the. Order stamps pay excise tax find retailer information and report sales of tobacco products to businesses located within special jurisdictions.

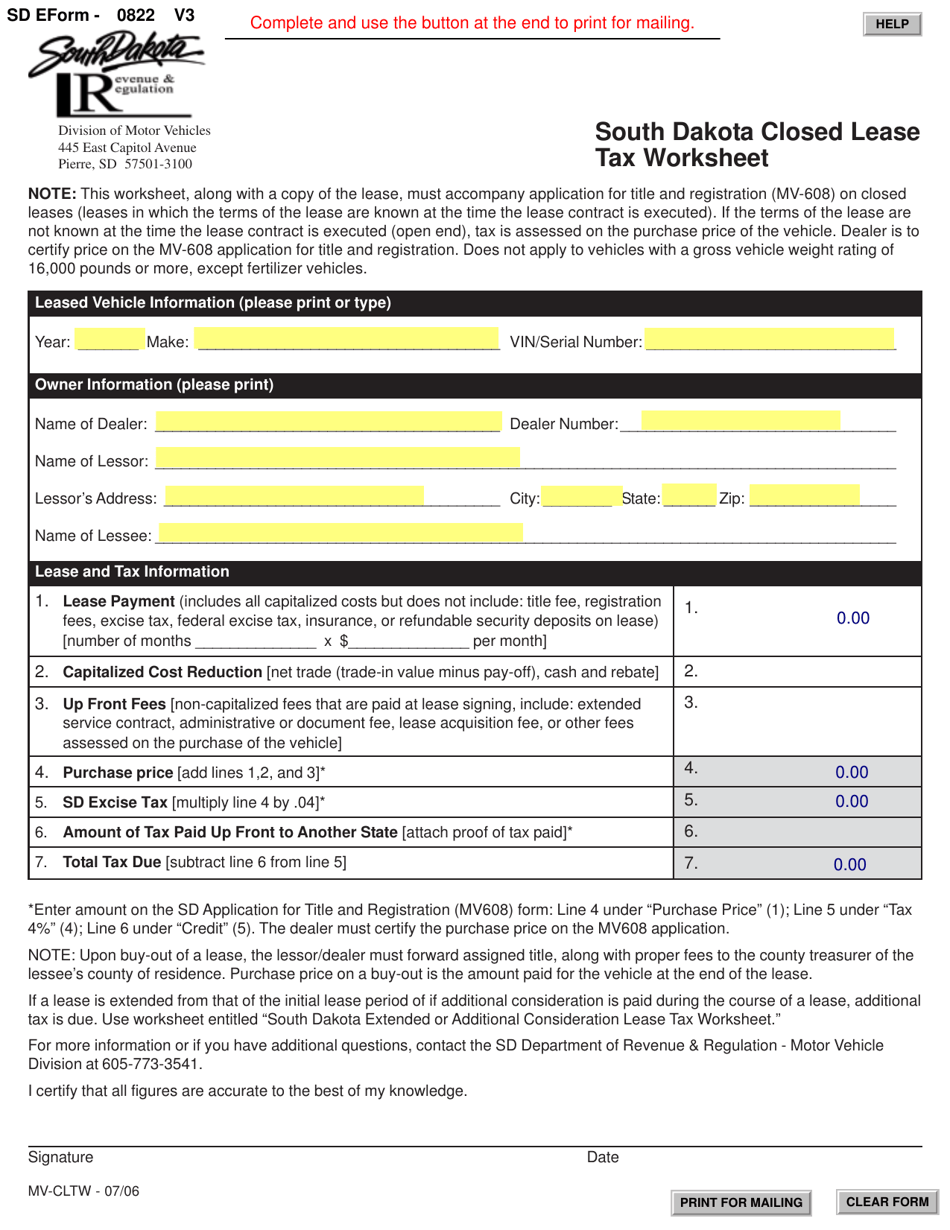

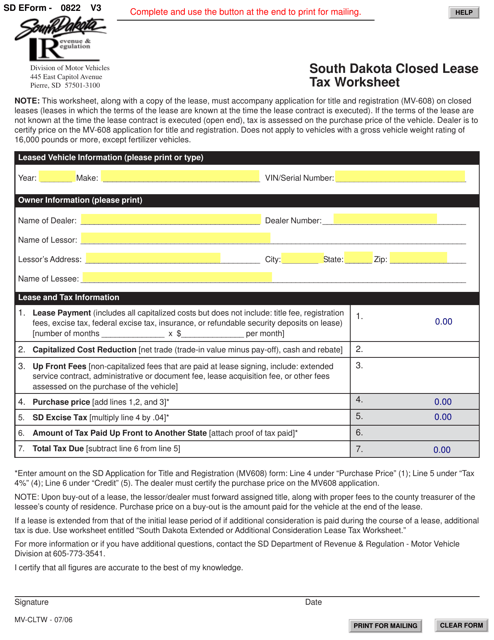

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

. Find information on which cigarettes are allowed to be sold in South Dakota. House trailer subject to 4 initial registration fee upon initial registration. Construction services include the construction building installation and remodeling of real property.

The South Dakota gas tax is included in the pump price at all gas stations in South Dakota. Enter the Total Tax this is line 2 on your last non-zero South Dakota Tax Return. 10 10 of the tax liability minimum 1000 penalty even if no tax is due is assessed if a return is not received within 30 days following the month the return is due.

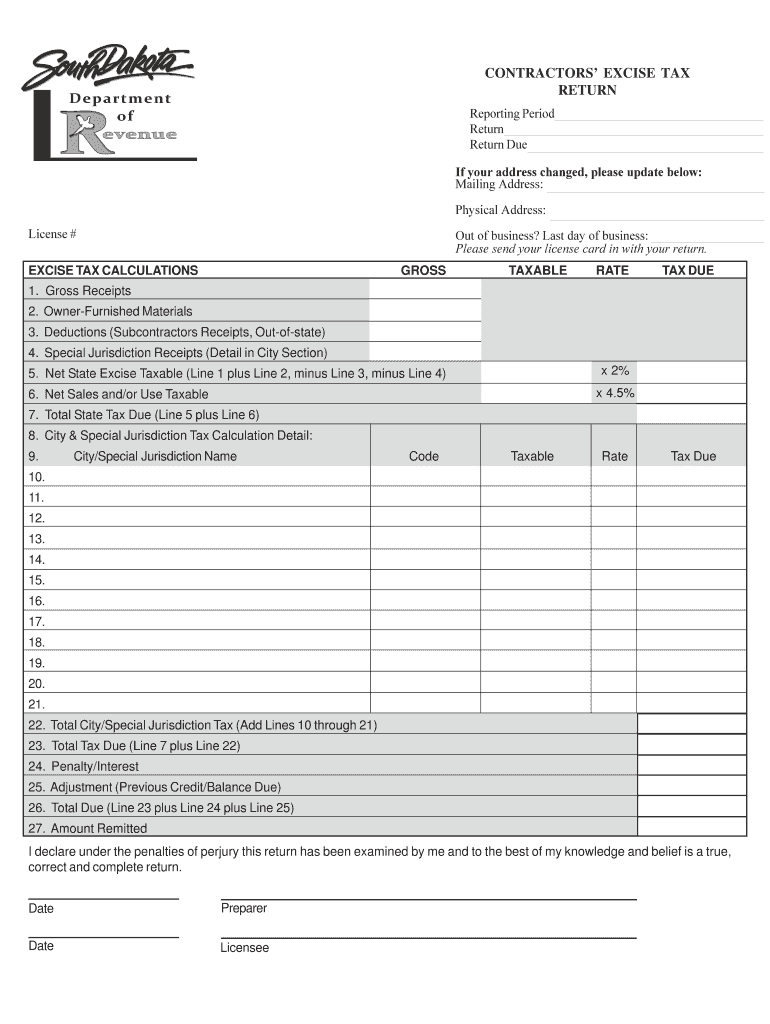

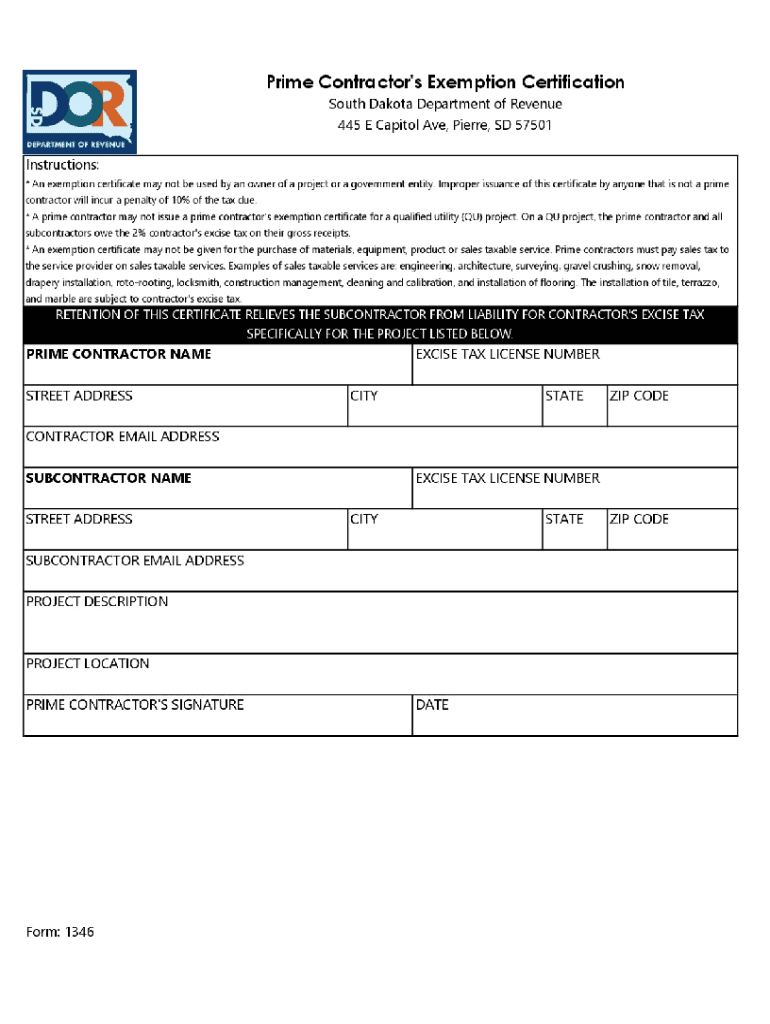

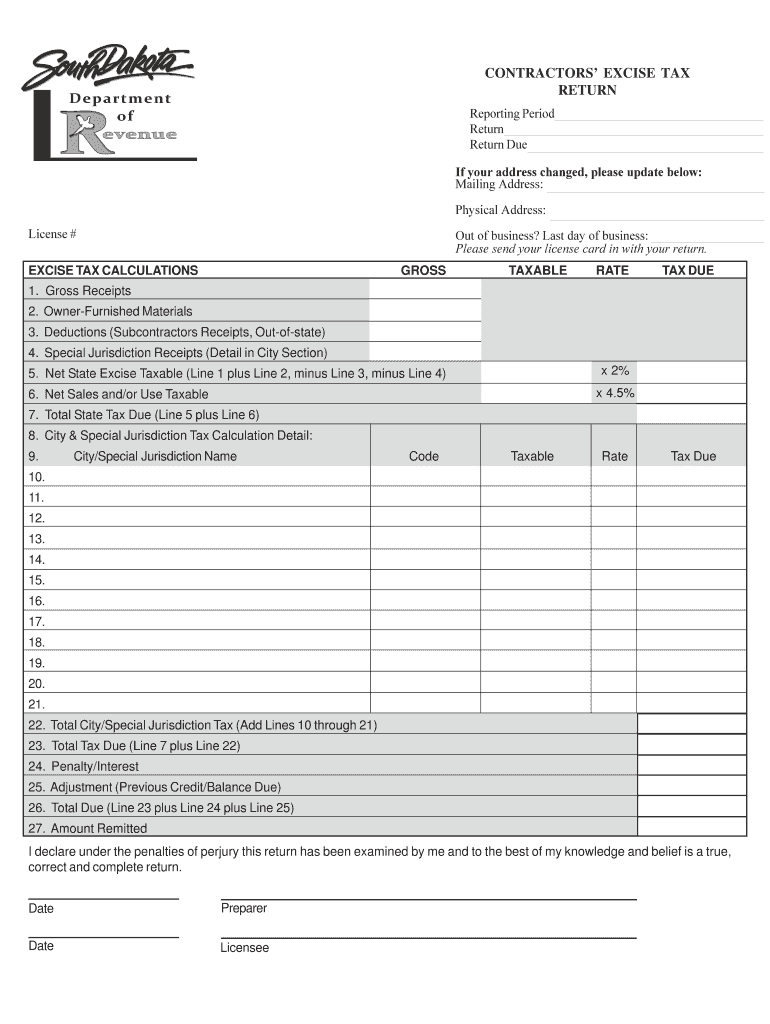

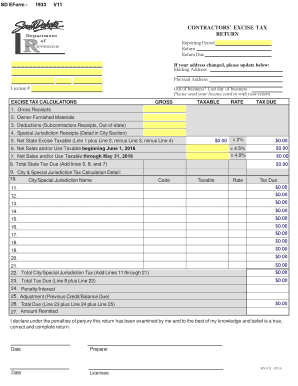

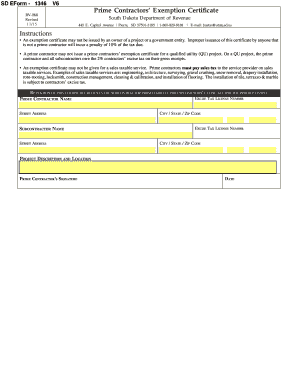

ACH Debit or Credit Card for the Taxes Listed above. Contractors excise tax is imposed on the gross receipts of all prime contractors engaged in. Any person entering into a contract for construction services must have a South Dakota contractors excise tax license.

Do NOT staple or paper clip. The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states. Contractor Excise License.

Excise Tax License South Dakota. For all general contracting companies operating in South Dakota you will have to obtain a business and occupational license and register for tax identification numbers. South Dakota Department of Revenue 445 East Capitol Ave Pierre SD 57501 How to Apply for a South Dakota Tax License There is no fee for a sales or contractors excise tax license.

Motor vehicle was on a licensed motor vehicle dealers inventory as of May 30 1985. If only your mailing address changes and the business location remains the same. If you owe tax and do not have a tax license please call 1-800-829-9188.

Enter the tax due line 23 from your last non-zero return. South Dakota doesnt have income tax so thats why Im using sales tax. Include receipts for projects located outside of South Dakota or any other non-taxable transactions that were included in Line 1.

However some state excise tax is deductible as personal property tax on Schedule A itemized deductions in place of car registration fees. Please use the box provided on the return to correct your address or notify the South Dakota Business Tax Division. The South Dakota income tax has one tax bracket with a maximum marginal income tax of 000 as of 2017.

Artisan Distiller Malt Beverage Manufacturer Carrier Liquor Common Carrier Microcidery Direct. Types of Alcohol Licenses. Motor vehicle excise tax exemption for disabled veterans and ex-prisoners of war MGL.

Fixture to real property must have a South Dakota contractors excise tax license. Sign up to file and pay your taxes electronically at the same time you. The South Dakota Department of Revenue requires all contractors who enter into a contract for construction services to carry a South Dakota contractors excise tax license.

Snow removal lawn care or consulting service. Please call the Department at 1-800-829-9188 if you have not reported tax due. Sales and Contractors Excise Tax License Application Contractors providing construction services must obtain an excise tax number.

July 1 1993 excise tax law. The check to the return. The North Dakota Office of State Tax Commissioner is the government agency responsible for administering the tax laws of North Dakota.

A license card will be issued once the license is approved. Get all the details from our Specialty ND License Plates page. Detailed South Dakota state income tax rates and brackets are.

No excise taxes are not deductible as sales tax. You may also have to adhere to South Dakotas 2 Excise Tax on the gross receipts of your contracting services. Excise Tax Calculation Gross Receipts Do NOT deduct out any tax before.

Washington per capita excise tax. Use EPath to file and pay the following taxes. This application allows for the renewal of the following alcohol and lottery licenses.

If you owe tax and do not have a tax license please call 1-800-829-9188. CONTRACTORS EXCISE TAX RETURN License. More information about the Contractors Excise License is available from the Department of.

Make Checks Payable to. As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South Dakota sales tax license and pay applicable sales tax. This includes repair or remodeling of existing real property or the construction of a new project.

For help please call the Special Taxes Division at 605-773-5911. Who This Impacts Marketplace providers are required to remit sales tax on all sales it facilitates into South Dakota if the thresholds of 200 or more transactions into South Dakota or 100000 or more in sales to South Dakota. If you have any questions regarding the lottery please contact South Dakota Lottery at 1-605-773-5770.

Find tax information laws. Get My FREE Quote. Do not have a sales tax license.

The link you have selected will direct you to an external website not operated by the North Dakota Office of State Tax Commissioner. Sales Use and Contractors Excise Tax licenses. Get application information from our Disabled Plates and Placards page.

This includes contractors who repair or remodel existing real. If you dont have an EPath account and need to make a payment by. Mailing address and office location.

South Dakota State Treasurer Please write your. Motorcycles only need a rear license plate. System maintenance will occure between 800am CST and 1200pm CST Sunday December 13 2015.

Total State Tax Due Add Lines 52 and 62 1. South Dakotas excise tax on gasoline is ranked 35 out of the 50 states. For starters South Dakota charges a 4 excise tax.

ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax. 8212017 0 Comments North Dakota Office of State Tax Commissioner. In addition for a car purchased in South Dakota there are other applicable fees including registration title and plate fees.

2021 Sd 1346 Formerly Rv 068 Fill Online Printable Fillable Blank Pdffiller

Sd Form 0822 Mv Cltw Download Fillable Pdf Or Fill Online South Dakota Closed Lease Tax Worksheet South Dakota Templateroller

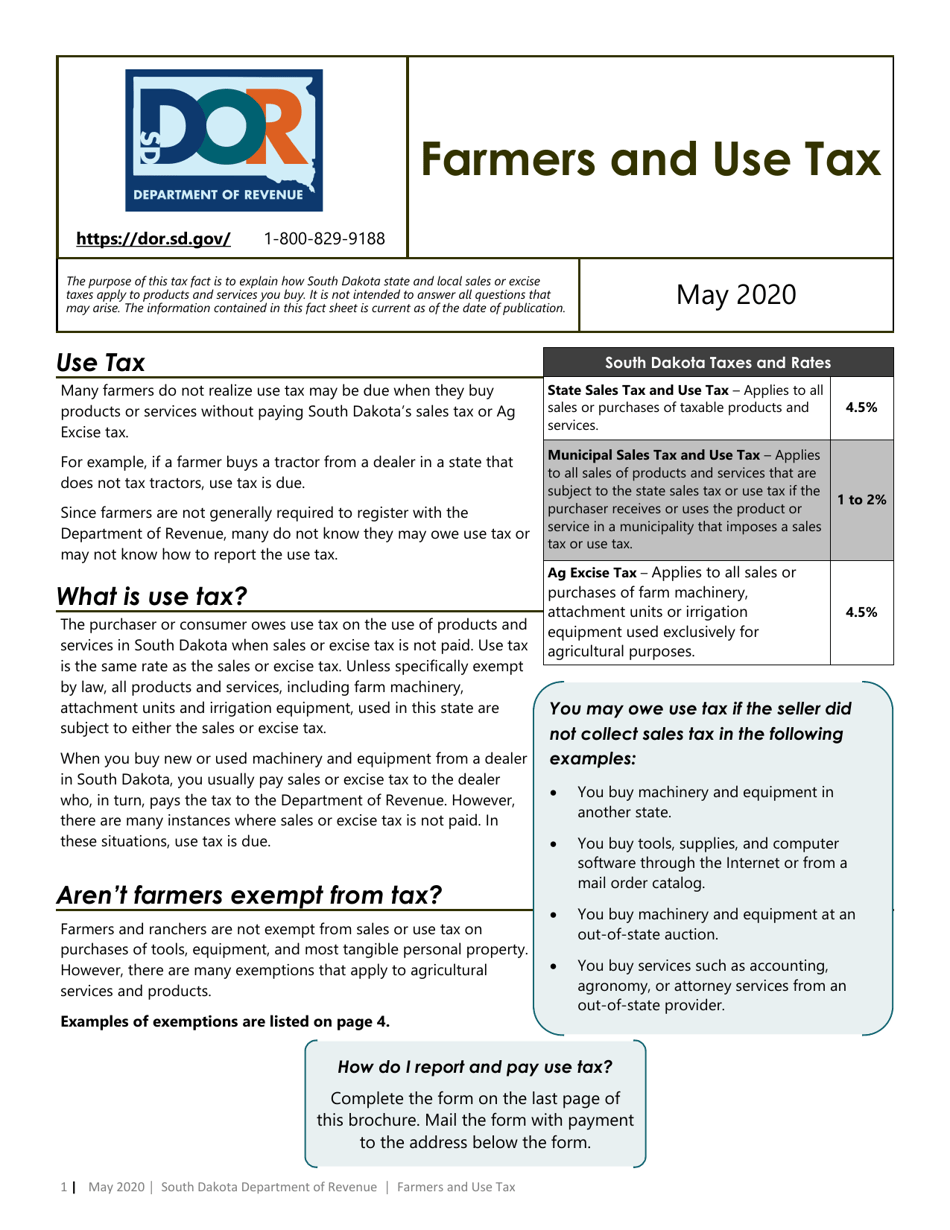

South Dakota Farmer S Use Tax Form Download Printable Pdf Templateroller

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

How To Register For A Sales Tax Permit In South Dakota Taxvalet

Sd Excise Tax Form Fill Online Printable Fillable Blank Pdffiller

Contractor S Excise Tax South Dakota Department Of Revenue

Sd Form 0822 Mv Cltw Download Fillable Pdf Or Fill Online South Dakota Closed Lease Tax Worksheet South Dakota Templateroller

2021 Sd 1346 Formerly Rv 068 Fill Online Printable Fillable Blank Pdffiller

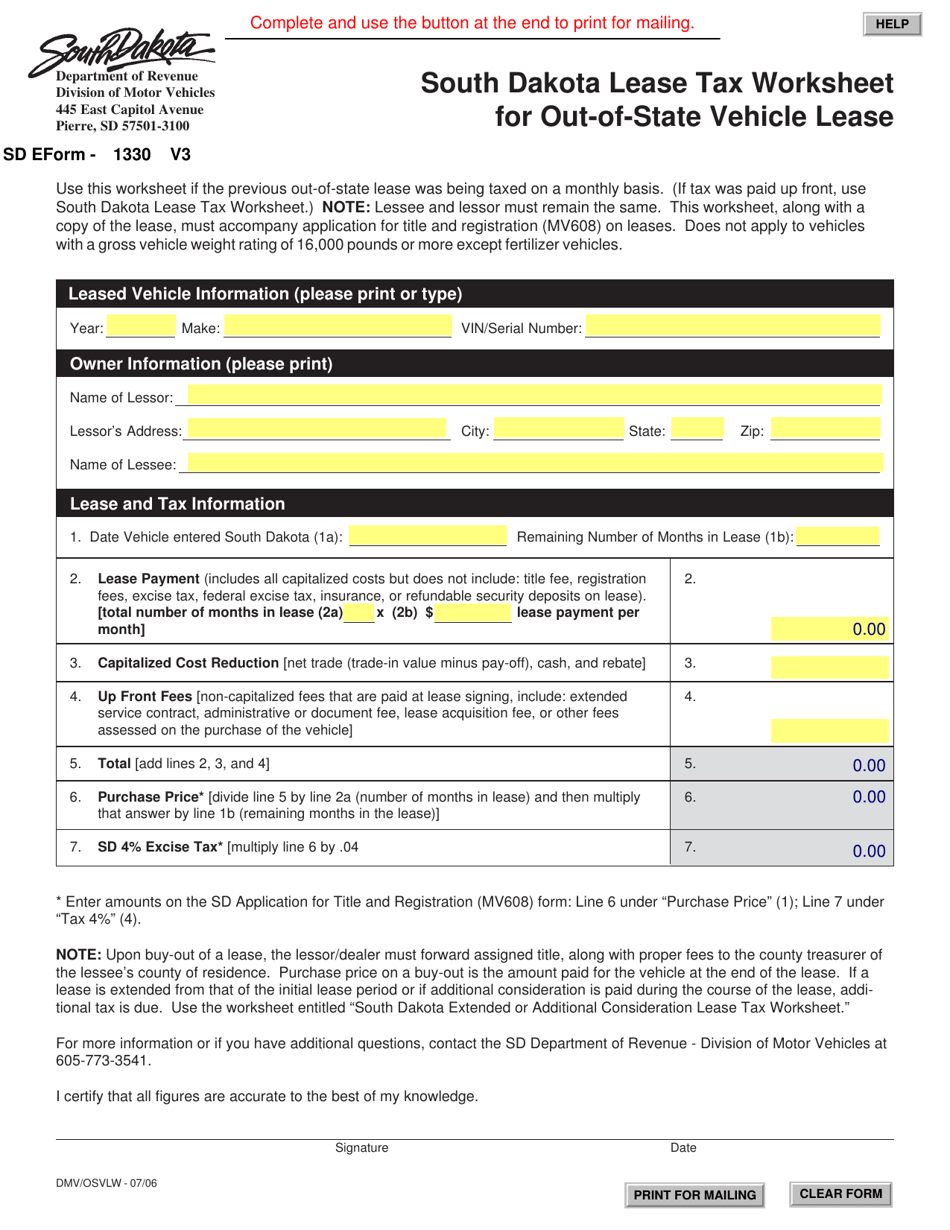

Sd Form 1330 Download Fillable Pdf Or Fill Online South Dakota Lease Tax Worksheet For Out Of State Vehicle Lease South Dakota Templateroller